Ø

GDP (Gross domestic product)

- The final products within the boundaries of India within that specific period of time are in the GDP of India. Further, the effect of inflation on these products is also calculated.

- GDP includes government expenditures, consumption, exports, imports, and investment of India.

- For example, if Honda decides to manufacture it’s parted in India than that will go into the GDP of India. But the revenues got through the sales are included in the GDP of Japan.

Ø

GNP (Gross national product

- GNP of the country is measured by the income which is collected due to the various factors of production that are owned by the residents or the citizens of India. The GNP of India is calculated by adding the net inflow coming from the abroad countries to the GDP of India while subtracting net outflow to the foreign countries from India.

As per the

previous example, if Honda is an Indian company and it is selling its parted in

other countries than that revenue becomes the GNP for India.

Ø

NET DOMESTIC PRODUCT (NDP)

The net domestic product (NDP) equals the gross domestic product (GDP) minus depreciation on a country's capital goods. Net domestic product accounts for capital that has been consumed over the year in the form of housing, vehicle, or machinery deterioration.

Ø Net National Product (NNP)

"Net national Product or

national income at

market prices is the net market money value of all the final goods and services

produced in a country during a year. It is found out by subtracting the amount

of depreciation of the existing capital in a year from the market value of all

final goods and services".

For a continuous flow of money payments, it is

necessary that a certain amount of money should be set aside from the gross

national income for meeting the necessary expenditure of wear and tear of all

capital equipment so that there should not be any deterioration in the capital

and it should remain intact. If we deduct depreciation allowance from gross

national product, we get Net National Product at current market price.

Formula for

Net National Product/National Income:

NNP

at Market Price = GNP at Market Price - Depreciation

PER CAPITA INCOME (PCI)

PER CAPITA INCOME (PCI)

It measures

the average income earned per person in a given area (city,

region, country, etc.) in a specified year. It is calculated by dividing the

area's total income by its total population.

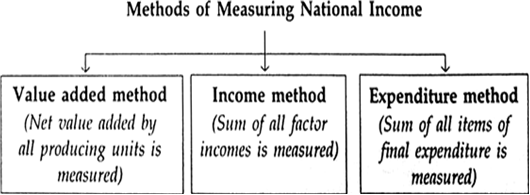

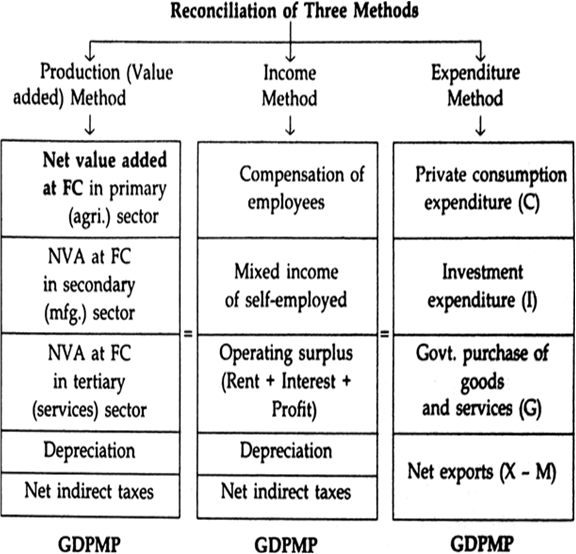

MEASURING NATIONAL INCOME

- Product/Production Method: It refers to the addition of value to the raw material (intermediate goods) by a firm due to its production activities.

- It is also known as ‘Inventory method’ or ‘Commodity Service Method’. It consists in finding out the market value of all goods and services produced in a country during a given period.

- We sum up the value of the gross product of all producers in an industry and from this total are deducted the value of the intermediate products consumed and depreciation of equipment during the process of production.

* Value added = Value of output – Intermediate consumption.

Q. What are the steps involved in

value added method?

Ø Classify all the

production units located in the domestic territory into distinct industrial

sectors: The units are classified into primary, secondary and tertiary sectors

which are further classified into sub-sectors like agriculture, manufacturing,

banking, etc.

Ø Estimate NVAFC of

each industrial sectors by taking the following sub-steps:

1.Estimate the value of

output and it can be estimated in two ways, firstly sum of sales and net

addition stock.

2.Deduct intermediate

consumption from value of output to arrive at GVAMP.

3.Deduct consumption of

fixed capital from GVAMP to arrive at NVAMP.

4.Deduct net indirect tax

from NVAMP to arrive at NVAFC of an industrial sector.

- Take the sum of NVAFC of all the industrial sectors of the economy. By doing so, we will arrive at net domestic product at factor cost (NDPFC).

- Add net factor income from abroad to NDPFC arrive at national income.

Q. Explain

the problem of double counting?

The term double counting

refers to an output more than once while passing through various stages of

production. It leads to over-estimation of national income or domestic income

in the economy. It can be explained with the help of an example:

- Stage1: Suppose a farmer produces 50kg wheat and sells is at Rs.5000 to the miller (flour mill). Therefore, final value of wheat for the farmer is Rs.5000.

- Stage2: For miller, whet is an intermediate good. He converts it into flour and it for Rs.700 to a baker. Therefore, final value of the flour for the miller will be Rs.700.

- Stage3: For baker, flour is an intermediate good. He manufactures bread from it and sells the bread to the final consumers for Rs.1000. Therefore, final value of bread for the baker is Rs.1000.

- If adding all the values of final goods (output), the total value of output = 500 + 700 + 1000 = Rs.2200.

Q. How is

the ways of avoiding double counting avoided?

The two alternative ways of avoiding double counting:

- Take value added instead of total output: It is necessary to identify intermediate consumption for this. From the above example, the intermediate consumption of farmer is nil. Whereas, that of baker and grocer is Rs.1000 and Rs.2000 respectively.

Thus, the sum total of

value added by farmer, baker and grocer is Rs.2200. Therefore, this is the

value that should be added in the national income as it is free from double

counting.

- Take the value of only the final product (output): The final products are those products which are purchased for consumption and investment. In the above example, only the value of grocer i.e. Rs.2200, is the final product because only he sells the entire output to the consumers.

- This value i.e. Rs.2200 includes the value added by all the three levels of production unit taken together which are Rs.1000 of farmer, Rs.1000 of baker and Rs.200 of the grocer.

Production

unit

Value

of output – Intermediate consumption.

Value

added

Farmer

500 – 0

500

Miller

700 – 500

200

Baker

1000 – 700

300

Total

2200 – 1200

1000

Q.

Explain how income generated in the economy is equal to NVAFC or

domestic income?

Or

Production

unit

|

Value

of output – Intermediate consumption.

|

Value

added

|

Farmer

|

500 – 0

|

500

|

Miller

|

700 – 500

|

200

|

Baker

|

1000 – 700

|

300

|

Total

|

2200 – 1200

|

1000

|

Q.

Explain how income generated in the economy is equal to NVAFC or

domestic income?

2.

The

Income Method:

This method consists in adding together all the income that accrued to the factors of production by way of wages, rents, interests and profits. This gives us national income classified by distributive shares. The factor owners are paid for the productive services rendered by them in money. The total money payments made to the factors of production in the economy represent the total money value at factor cost. What is factor payment (cost) for the producers is factor income (earning) for the factor owners. Thus, under income approach GNP is found by adding up the total factor incomes generated in producing the national product.

Components

of Income Method:

Ø Compensation of employees: It refers to the amount paid to

employees by employer for rendering productive services.

a) Wages and salaries in cash: It includes all monetary benefits

like wages, salaries, bonus, commission, etc.

b) Wages and salaries in kind: It includes all non-monetary

benefits like rent, free home, free car, free transport, imputed interest of

interest free loans, etc.

c) Employer’s contribution to social security schemes: It includes contribution

made by the employer for the social security of employees such as contribution

to provident funds, gratuity, retirement pension, insurance, etc.

Ø Rent and Royalty: Rent is that part of national income

which arises from ownership of land and building. Royalty refers to income received from granting leasing rights of

sub-soil assets.

Ø Interest: It refers to amount received from lending funds to a

production unit.

Ø Profit: It is the reward to the entrepreneur for his contributions to

the production of goods and services. It includes:

a) Corporate tax: It is direct tax paid by an enterprise to the

government on the total profit earned by it.

b) Dividend: It refers to that part of profit which is paid to the

shareholders in the ratio of their shareholding.

c) Retained earnings: It refers to that part of profit

which is kept as reserve to meet unexpected contingencies or business

expansion.

d) Mixed Income: It is the income of the unorganized sector or the

self-employed people. In this sector factors of production are not hired from

factor market. Rather, own resources are used in the production. So the income

generated in this sector will be mixture of rent, interest, profit and wages

and they cannot be separated from each other. That’s why, it is called mixed

income of self-employed.

For e.g.: Doctor running his

own clinic, CA practicing from his house, etc.

Q.

What are the steps of income method in estimating national income?

3. The Expenditure Method:

Under this

method we add up personal consumption expenditures, the gross private domestic

investment, the Government purchase of goods and services and the net foreign

investment to obtain GNP at market prices. We deduct depreciation to obtain Net National Product (NNP) at market price, less Indirect Taxes give us net national income at factor

cost. In this method of national product measurement, the GNP is regarded as a

flow of total goods and services bought through the money payments by the

community.

Components of Expenditure Method:

Ø Private

Final Consumption Expenditure (PFCE): It refers to expenditure incurred by the

households and private non-profit institutions serving households of all types

of consumer goods i.e. durable goods, non-durable goods, semi-durable goods and

services.

Ø Government

Final Consumption Expenditure (GFCE): It refers to the expenditure incurred by

general government on various administrative services like law and orders,

defense, education, etc.

Ø Gross

Domestic Capital Formation (GDCF)/Gross Investment: It refers to the addition to capital stock of

the economy.

Ø Net Exports

(X - M): It refers to

the difference between export and imports of a country during a period of one

year.

Q. What are the steps of expenditure method in

calculation of national income?

The steps of expenditure method in calculation of national income are as follows:

Step1: Identify the economic units incurring final expenditure. These economic units are classified into four groups:

NDPFC = GDPMP – Depreciation – Net Indirect taxes.

Step4: Estimate net factor income from abroad (NFIA) to arrive at national income. NFIA is added to domestic income to get National income.

NNPFC = NDPFC + NFIA.

The steps of expenditure method in calculation of national income are as follows:

Step1: Identify the economic units incurring final expenditure. These economic units are classified into four groups:

a) Households

b) Government

c) Production unit

d) Rest of the world.

Step2: Classification of final expenditure. The above

economic units estimated as:

a) Private final consumption expenditure (PFCE)

b) Government final consumption expenditure (GFCE)

c) Gross domestic capital formation (GDCF)

d) X – M (export - import).

The sum total of these four component gives

GDPMP.

Step3: Calculate domestic income (NDPFC).

By subtracting the amount of depreciation and net indirect taxes from GDPMP,

we get domestic income.NDPFC = GDPMP – Depreciation – Net Indirect taxes.

Step4: Estimate net factor income from abroad (NFIA) to arrive at national income. NFIA is added to domestic income to get National income.

NNPFC = NDPFC + NFIA.

Nic

ReplyDeleteVery informative article! Keep sharing.

ReplyDeleteNice 👌

ReplyDeleteNice👌

ReplyDelete